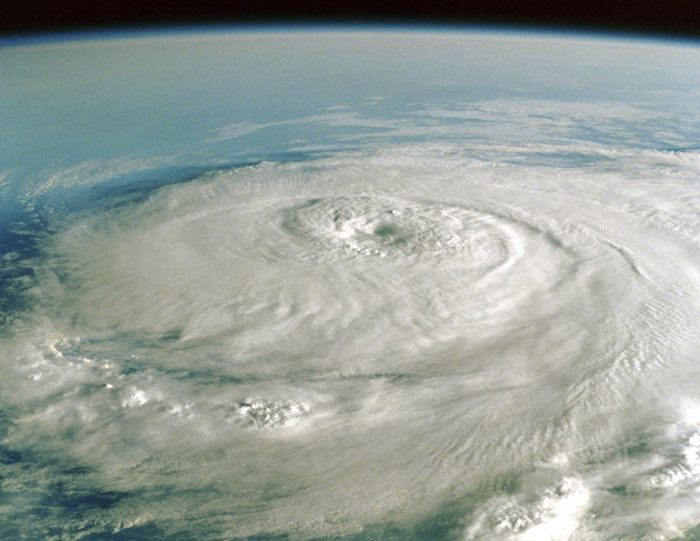

Hurricane FAQ's

NOAA National Weather Service forecasters at the Climate Prediction Center predict above-normal hurricane activity in the Atlantic basin this year. NOAA’s outlook for the 2024 Atlantic hurricane season, which spans from June 1 to November 30, predicts an 85% chance of an above-normal season, a 10% chance of a near-normal season and a 5% chance of a below-normal season.

As one of the strongest El Ninos ever observed nears its end, NOAA scientists predict a quick transition to La Nina conditions, which are conducive to Atlantic hurricane activity because La Nina tends to lessen wind shear in the tropics. At the same time, abundant oceanic heat content in the tropical Atlantic Ocean and Caribbean Sea creates more energy to fuel storm development.

NOAA is forecasting a range of 17 to 25 total named storms (winds of 39 mph or higher). Of those, 8 to 13 are forecast to become hurricanes (winds of 74 mph or higher), including 4 to 7 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher). Forecasters have a 70% confidence in these ranges. An average season is considered 14 named storms, seven hurricanes and three major hurricanes.

However, when the NOAA/National Hurricane Center announces the formation of a tropical system, which threatens the United States, our ability to bind coverage may be temporarily restricted. It is the customary practice of our Carriers to limit binding during an approaching storm. It is not permissible to bind any new business or to increase any existing property, inland marine, or automobile physical damage coverage within 100 miles of any coastal area that is potentially impacted by the NOAA National Hurricane Center’s 5-day forecast, showing an approaching storm to specific areas. These restrictions will remain in force until the storm has passed and until 24 hours after the tropical depression/storm/hurricane watch or warnings are removed. You can contact us to determine when restrictions are lifted.

1) Contact your Insurance Carrier's Claims Department: If you have suffered damage to your home or car, contact your insurance company's claims department as soon as possible. After a disaster, insurance companies and their adjusters are swamped with claims, and getting yours in sooner should result getting your claim check sooner. Try to have your policy number in hand when calling. A FULL LIST OF FLORIDA PROPERTY INSURANCE CARRIER CLAIMS NUMBERS ARE LINKED HERE.

Due to the volume and severity of the storm, it may take several days (in some cases) before an adjuster contacts you to discuss the claim. In the meantime, you can expedite the process by doing the following below.

2) Make temporary immediate repairs: Make any repairs that will temporarily keep the damage from getting worse, such as covering a hole in your roof, water extraction, or boarding up a broken window. Keep the receipts for these repairs so that you can be reimbursed by your insurance company. Don't start making permanent repairs until an adjuster has assessed your house. For immediate assistance contact a local emergency restoration company or a preferred vendor by the insurance carrier.

3) Inventory damaged possessions: Carefully make a list of all possessions damaged by the hurricane. Take photos or video of the damage to help speed the claims process along, too. Don't be taken for a ride. Beware of unscrupulous contractors who appear at your door, offering to quickly make repairs for cash. Also, avoid contractors who use Assignment of Benefits language in their contracts! Assignment of benefits scams are a leading cause of rising insurance rates, and fraud artists see a hurricane aftermath as a golden opportunity to prey on unsuspecting homeowners. Insurance policyholders should always call their insurance company first, to report a loss and determine the best way to proceed.

Hurricane Claims FAQ's

1) "I have reported my claim, now what should I do?"

You should take all steps necessary to prevent further damage -- securing property, temporarily boarding windows and roof, drying out carpets and personal property, etc. If the insured does not do this and further damage results, it may not be covered.

You should not undertake any permanent repairs, nor dispose of any damaged property before an adjuster has been able to see the damage. When there is water damage to the contents of a home, you should remove water-soaked contents such as carpeting and furniture, however you should not dispose of such items before an insurance adjuster sees them. You can place such items outside under a tarpaulin. In the case of perishable items (i.e., food) that must be disposed of, first take photographs of that property to substantiate the claim. If you do not, some damages may not be covered.

You should retain all receipts for emergency repairs and for items which might qualify under additional living expenses (such as hotel charges if the home is uninhabitable, etc.).

2) "Is there anything I can do to speed up the claims process?"

Although the adjuster will contact you as soon as possible, priority will be given to the most severe losses. Also be aware that larger claims will be settled in stages, not all at once. While waiting for the adjuster, there are a number of things you can do:

You may wish to secure a repair estimate (preferably at least two) for the adjuster to review. This will help the adjuster with the settlement process. Take pictures of the damaged property. If you have pictures of the property before the loss, these should be provided to the adjuster.

Make a list of all damaged property, including a description, age, original cost, and place of purchase and estimated replacement cost. Any receipts or canceled checks for these items should also be included.

3) "What if my home is so damaged I can’t stay in it?"

Under most homeowners and dwelling forms, coverage is provided for Additional Living Expenses. If the home is uninhabitable due to a covered peril and you must temporarily relocate, most policies will reimburse for the reasonable expenses incurred over and above your normal living costs. For example, it would probably cover all reasonable housing expenses since you will be paying a mortgage payment, but would only cover food expenses over and above what the policyholder normally would pay for food.

It is imperative that you retain all receipts for these expenses in order for them to be considered as a part of the loss. The expenses must be in line with normal living costs and must be a necessary and direct result of the loss.

Most policies limit recovery under Additional Living Expenses to a percentage of the amount of coverage on the home itself.

4) "What coverage is there for trees that are down?"

There is no coverage under standard dwelling and homeowners policies for damage to trees by “weather perils” (such as wind). However, if the tree falls and causes damage to some other type of covered property (such as a house or fence), the damage to the house or fence would be covered. Separate windstorm coverage can be purchased as an added endorsement.

5) “Power was out for five days and the food in my freezer and refrigerator spoiled. Is it covered?”

Generally, most residential policies do not cover food spoilage resulting from power outages due to the “Power Failure” exclusion. A small number of companies provide some very limited coverage (i.e., $250 - $500) as a coverage enhancement. Aside from this, coverage is generally not available.

6) “When power finally came back on, a power surge damaged some of my electrical equipment. Is it covered?”

Most homeowners policies provide coverage as “sudden and accidental damage from artificially generated electrical current”; however, coverage does not apply to loss of transistors, computer chips and similar items. Therefore, damage from a power surge would not be covered for property such as televisions, VCRs, computers or similar items. To prevent this, buy a quality surge protector for the outlet of computers, tv's, etc.

7) “The adjuster was here last week and I still haven’t gotten my check. How long is this going to take?”

After the adjuster has visited the insured, he must complete detailed paperwork on the loss, which is subsequently submitted to the carrier for review. After everything has been checked, the carrier will issue the claims draft to the insured. If the adjuster is carrying a heavy claim load, there is often quite a delay in completing the paperwork by the adjuster, since they generally must do this at night, as well as the delay at the company as it deals with thousands of claims to review at one time. Often, an insurance agent can check with the adjuster to find out exactly when the paperwork was submitted to the carrier. If the papers have been sent in, the company may also be able to provide a status report.

8) “What does Replacement Cost Coverage mean?"

If the policy indicates that settlement will be on a replacement cost basis, then payment will be made for the actual cost to repair or replace at today's prices, limited only by the total amount of coverage that was purchased.

MacDowell Insurance, Inc.

Home - Auto - Commercial

420 Lake Howell Rd Maitland, Fl 32751 I Ph: 407-628-2200